🕵🏻♂️ Account blindness

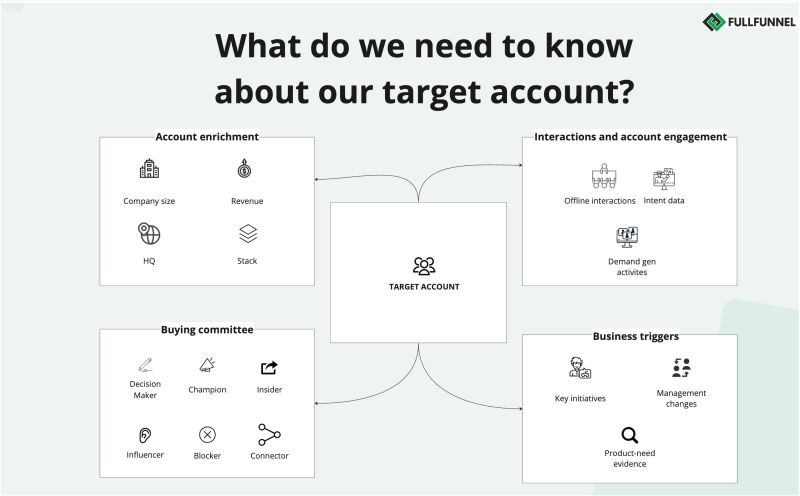

4 pillars of data you need to know about your target accounts and how to collect insights & buying signals about target accounts

A lot of B2B companies deal with account blindness:

Trying to market and sell to the accounts without knowing if the account is in market, if they are problem aware and if they are vendor aware.

They assume that all the companies that fit their firmographics criteria (e.g. Healthcare organizations in North America with 1k+ people) by default have a challenge their product solves.

Marketing is supposed to capture the demand from those that are in market with direct ads and create awareness through keyword-based content.

Sales is supposed to contact as many people as possible through outbound motion, help potential buyers to uncover their challenge and sell.

The sad reality is that most of these accounts are problem unaware and vendor unaware, hence they ignore ads and outreach.

If you want to land an enterprise opportunity, you must be relevant.

To be relevant, you need to answer one question:

What do we need to know about our target account and buyers to create a relevant messaging, nurturing and buyer enablement content, and proposal.

Today we're going to cover:

4 pillars of data you need to know about your target accounts

Progressive profiling or how to collect this data through multiple touchpoints

Let's dive in!

How to leverage SDRs in ABM programs to drive pipeline

We couldn’t make it to the live Demandbase event in London, so agreed to participate in their next virtual ABM conference “Make it count”.

In our session we'll share:

Account-based sales reps model that converts 5-15% of target accounts into sales opportunities

5 new SDR functions to generate pipeline and revenue

How SDRs can create awareness among target buyers and collaborate with marketing to fill in top of the funnel

New KPIs that lead to revenue and pipeline generation

4 pillars of data you need to know about your target accounts

If sales could sell the product to anyone, anytime, each company would be a unicorn.

Experienced sellers know this. Just ask them:

"If you had to bet your compensation on a prospect, what would you need to know?"

In most cases, you'll hear about these 4 pillars of data.

1. Firmographics and technographics.

This cluster includes publicly available information to qualify and segment account

Company size

HQ location

Revenue

Stack, etc

2. Touchpoints with the account.

Collect in one place all the interactions with target account:

Meeting with DMs at the conference

Sending personalized direct mail swags

Webinar sign-ups

Engagement with LinkedIn ads

Email replies, etc.

High-intent page visits

Niche-based/product-based content hub visits

Below I’ll share how to actually collect them.

3. Buying committee.

Who are your economical and technical buyers? Who are your target users?

You need to identify real people beyond the titles "VP of.. / Chief .... Officer", who influence your opportunity.

What are their jobs-to-be-done, goals, challenges, and how does our product fit?

Think about 6 roles :

Champions

Decision-makers

Influencers

Blockers

Connectors

Insiders

* Check this guide where I describe different buying committee roles.

Make sure you have accurate emails and LinkedIn profile URLs.

4. Product need evidence.

What is the evidence that an account might have a need for our product?

Here is a list of idea that can navigate you into right direction

Unsatisfied with a current process (e.g. churn rate is higher then they want)

Hiring for specific roles

Announcing new initiative

Asking for a solution to a specific challenge in the communities (e.g. our MQLs stopped converting and sales blame us. We want to launch a pilot ABM program. Does anybody have a framework?)

If you have a holistic overview of all interactions with the target account in one place, you can:

easily personalize message, nurturing content and offer to "active focus list" (highly engaged accounts)

Segment all accounts by a similar challenge.

Develop the right brand awareness and nurturing cluster program for the "future pipelie"

Now let's cover how marketing and sales can collect this data.

Let's dive in!

GET ACCESS TO A NEW FULL-FUNNEL ABM 2.0 COURSE

What's included with the course access:

12 modules covering step-by-step ABM strategy development: goal decomposition, ICP, account list building, ABM team, warm-up and activation playbooks, reporting, scaling ABM and building a cohesive ABM & demand gen function.

Short explanation videos and "how to" examples. We believe it's better one time to see a practical example then listen to the theory hundreds of times.

5 orchestrated and ready-to-use ABM playbooks and a detailed explanation

Report dashboard for 4 types of ABM programs: new revenue, pipeline acceleration, expansion and churn prevention

Live case studies and examples of the campaigns we implemented with the clients of Fullfunnel.io in the past few years

17 templates to simplify your ABM strategy launch: ICP, revenue analysis, intent data tracking, account warm-up cadence, customer research, account scoring and prioritization, ABM budget planning and forecasting, account planning, reports, personalized offers, and many more.

Planning & Presenting a Pilot ABM Program to Execs and Sales Framework

Minimal viable stack recommendation and guidelines on how to use it to avoid ramping up budget and being pressured to show ROI for the purchased $50k software

3 stages of ABM motion

Progressive profiling or how to collect insights about target accounts from multiple touchpoints

How can we gradually collect this information as a team?

Previous data pillars I've shared can be divided into 2 categories:

Publicly available information (firmographics and techno graphics)

Discovered through 1–1 conversations

You need to map each criterion to a specific sales or marketing activity. Below are examples.

1. Online research / data sources.

What information do we need to collect from research and data sources?

Example:

ACV > $50k? → Infer from websites or review sites

A sales team of 100+ → LinkedIn (Sales Nav)

2. Marketing touchpoints.

List all the marketing activities and touchpoints, and the info you can collect.

Examples.

A form question in newsletter or webinar signup

A question on the thank-you page

Enrichment upon signup

Webinar poll

LinkedIn poll

Buyer survey

3. Social chat.

What questions can we ask when having a LinkedIn or community chat with a target buyer?

4. Insider information.

What can we find out from common connections? Or from peers on the team of the target buyer?

5. Discovery calls.

What is the info you can only find through a conversation?

Map the questions to ask during discovery calls, but also questions that we can ask during e.g. a podcast pre-production interview.

The more playbooks you'll develop around non-sales touchpoints with your target buyers, the more information you'll be able to collect, and the more "warmed up" will be your accounts.

Ultimately, when you know the challenge of a target buyer, you can create a cluster of accounts with a similar challenge, develop a relevant nurturing program and generate sales opportunities.

In the next newsletter we’ll share with you a step-by-step process.

Stay tuned!

Drive pipeline THIS quarter with a full-funnel ABM programs.

If any of these challenges sound familiar:

You are aligned in theory with sales but don’t do anything in practice aside from receiving wish lists from sales and sharing with them your marketing plan. In reality, you work in silos and miss the revenue targets and are being pressured by your executives.

You understand that your marketing and sales playbook is broken (mqls, gated content) but despite many attempts you don’t know how to fix it

Your outbound, paid ads and organic pipeline drastically decreased while CAC increased mostly because most of your market is problem unaware and not buying.

You lack brand awareness among target accounts and sales can’t get even a reply.

You clearly see that you're already behind your revenue targets

We can help.

We'll develop a custom full-funnel ABM strategy aligned with your resources, budget and stack and execute it together to drive results THIS quarter.