🕵🏻♂️ Selecting accounts for ABM program

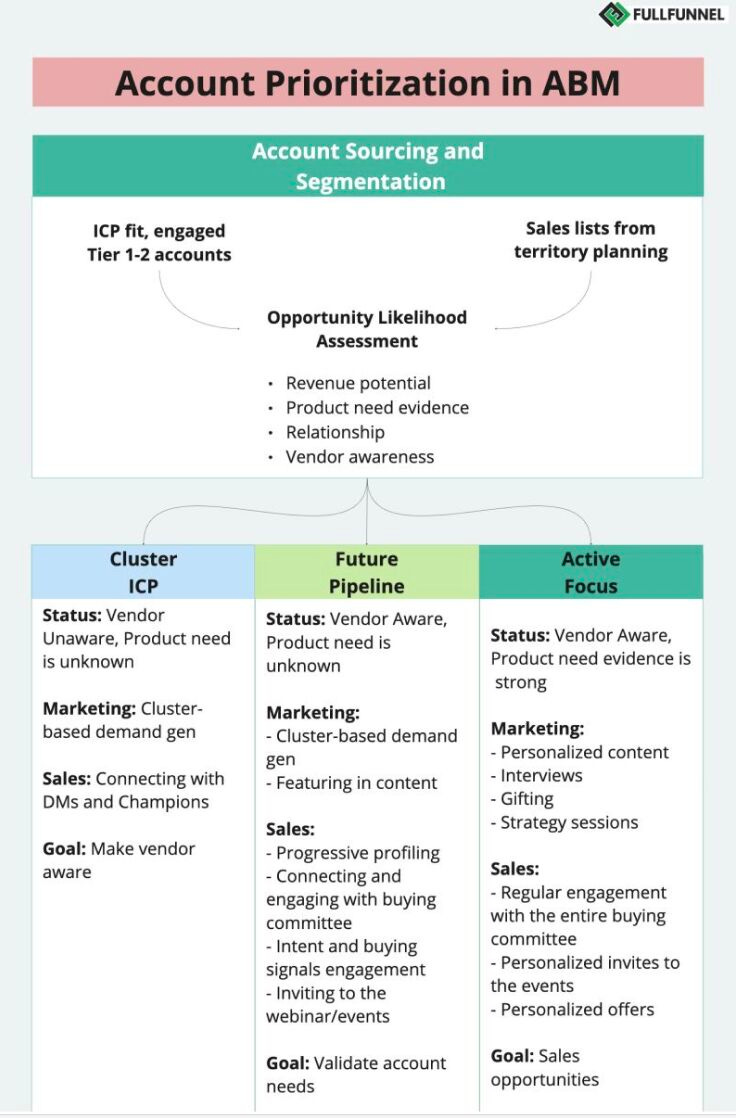

Our account prioritization framework to select the accounts that are likely to become sales opportunities.

In many B2B companies, sales and marketing planning (including account selection) happens in silos. Once a year during sales kick-off (SKO), sales:

Pick up the biggest accounts (aka the wish list)

Define target stakeholders

All accounts are assigned by territory and size to AEs and BDRs (aka territory planning)

When marketing suggests to try ABM, sales usually share back the wish list.

You know well what happens next.

Marketing runs more targeted demand gen to generate MQLs and inbound inquiries with further handover to sales.

Sales sends the same outbound cadences personalized by title and the research pulled from ChatGPT.

All accounts are treated the same way. Nobody questions it until the revenue targets are hit.

Now, pause for a second and guess who is blamed when this program fails?

Today we’ll share:

The #1 pre-requisite for account selection

4 pillars of account prioritization framework

How we selected accounts for Fullfunnel.io ABM program in Q4 2025 (51 accounts, 1 closed won, 4 sales opportunities)

BECOME A FULL-FUNNEL B2B MARKETER

Full-Funnel Academy is a comprehensive B2B marketing training and Slack community for B2B marketers who care about revenue and want to move the needle.

Academy includes:

All our B2B marketing courses including ABM playbook, Demand Gen Playbook, LinkedIn Allbound marketing playbook and 11 more courses that aren’t available publicly + all upcoming courses.

Private Slack community to answer all your questions

Personalized learning plan. If you are not sure what skills you’d develop in the first place and how to get maximum from the program, we can create a personalized learning plan accordingly to the time you can dedicate to education.

Behind-the-scenes sessions. See what’s working and what doesn’t work and why on the “behind the scenes” sessions where we review the campaigns we are running for our clients and us.

Learn more and join the academy here.

Cluster selection and account qualification as the #1 pre-requisite for account selection

Before prioritizing and selecting accounts, all of them should be qualified. Just because the account is in your area or meets firmographic criteria (e.g. big bank in North America) doesn't mean that it's a good fit.

Honestly, this is where the conversation with sales can go harsh. You might immediately hear: “We’ve already selected them.”

Instead of pushing back, suggest to work together on:

*Check two articles above where we explain both processes step-by-step

Next, qualify all accounts selected by sales by cluster ICP qualification criteria. Once done, you might hear another question:

Which accounts deserve full sales attention and fully personalized approach?

Here is what we are going to cover next.

Account prioritization framework: 4 pillars.

Whenever we start a new ABM program with clients, I always ask sales and marketing during onboarding:

If you were going to bet my compensation on accounts that are likely to become sales opportunities, what are the criteria I need to apply to identify them?

You don't need thousands of accounts to target – marketing and sales are not a bingo. You need to select accounts that are likely to become sales opportunities.

Here are four pillars to define which accounts you should focus on.

1. Revenue potential.

Are you hunting antelope or field mice?

Not all accounts are equal. Prioritize tier 1 and tier 2 accounts with the highest and medium revenue potential.

If you close a $10K deal and a $200K deal with the same effort, which one moves your business forward?

This is exact reason why we never add Tier 3 accounts to ABM program.

2. Vendor awareness.

Are the accounts that we want to target already aware of our product?

Are there any engagements and touchpoints we had with them?

The last question is essential because it helps you to separate "cold accounts" (no engagement) from the accounts that are already aware of your brand.

Cold accounts should be put into a Cluster ICP list and added to your cluster-based demand gen program. While “aware” or “engaged” accounts are moved to Future pipeline (I’ll describe the list definitions next).

You’ll see much better engagement, reply rates and account-to-pipeline with engaged accounts. This helps to demonstrate sales the early wins and keep them engaged.

To identify "aware" and "engaged accounts" look at your marketing automation and intent data:

Recent sign-ups to your cluster-based webinars

High-intent website page visits (demo, pricing, case studies, vertical/role solutions, comparison reports)

Engagement with your thought leadership content and demand gen ads, etc.

3. Relationship.

Do you know anybody who works for the target accounts? Someone closely connected to the buying committee?

Someone who can make an intro or share insider information about the account’s needs and challenges?

If you already have a warm connection inside target accounts, you can accelerate account research and validate if your product is the right fit.

Pay attention to:

Ex-clients who joined new companies

People you met at conferences and industry events

People who engaged with you: liking/commenting your posts, subscribing to your newsletter, attending your webinars

4. Product need or challenge evidence + buying signals.

Are there facts that tell you the account might have a challenge your product solves?

Define product-need evidence signals you can collect through progressive profiling and account research.

*I prefer product need evidence to buying signals for a simple reason. Buying signal is when an account explicitly asks you about the quote. All other signals just demonstrate the evidence that an account might need your product.

Examples:

Actively hiring for a specific role

Announced losses, key initiatives, or roadmap in annual reports

Legacy technology or specific tech stack gaps

Executive LinkedIn posts mentioning relevant challenges or strategic initiatives

This simple exercise helps you to identify three groups of accounts that fit your ICP':

No awareness, no relationship, no product need evidence signals

Awareness or relationship with somebody from buying committee group, but no product need evidence signals

Hit your awareness threshold, have an engaged buyer, product need signals are uncovered

As you might guess, all three groups of accounts should be approached differently.

Here is what we’ll cover next.

Drive pipeline THIS quarter with full-funnel ABM programs.

If any of these challenges sound familiar:

You are aligned in theory with sales but don’t do anything in practice aside from receiving wish lists from sales and sharing with them your marketing plan. In reality, you work in silos and miss the revenue targets and are being pressured by your executives.

You understand that your marketing and sales playbook is broken (mqls, gated content) but despite many attempts you don’t know how to fix it

Your outbound, paid ads and organic pipeline drastically decreased while CAC increased mostly because most of your market is problem unaware and not buying.

You lack brand awareness among target accounts and sales can’t get even a reply.

You clearly see that you’re already behind your revenue targets

We can help.

We’ll develop a custom full-funnel ABM strategy aligned with your resources, budget and stack and execute it together to drive results THIS quarter.

How to prioritize accounts: 3 lists.

Here is how you should segment your accounts into 3 lists, and how to approach them.

1. CLUSTER ICP.

Cluster - groups of companies with a similar challenge/use case despite their tier or vertical.

These accounts fit your ICP but are not vendor aware, and there is no clear evidence they have a challenge your product solves.

Instead of pitching to them and targeting with ads, your goal is to make them vendor aware first.

Opportunity likelihood: <5%.

This list should be put into a cluster demand generation and brand awareness program.

Your program should include:

Ongoing customer research to understand better buyers challenges, jobs to be done, and the necessary change management

Messaging and content aligned with the insights from the customer research

Partnerships and collaborations with the industry thought leaders and vendors your buyers trust

Mix of events: business breakfasts, webinars, peers discussions.

KPIs:

Inbound sales opportunities

Engaged accounts (sourced to ABM team)

2. FUTURE PIPELINE.

These accounts are vendor aware (there was some engagement, but no buying intent), but you have no idea if they have a challenge your product solves.

Nurture these accounts with segmented content while connecting, engaging and profiling the buying committee.

Your goal is to validate if an account has an actual challenge, and if they prioritized it.

Current opportunity likelihood is <30%.

Goals:

Run account research and map out the buying committee

Connect and engage with multiple buying committee members

Validate / figure out challenge (progressive profiling)

KPIs:

Profiled accounts

Account penetration (with how many buyers you connected)

3. ACTIVE FOCUS.

These accounts demonstrate a strong engagement, there is a relationship with the buying committee members and a strong product need evidence.

These are the accounts your marketing and sales team should focus on opportunity development.

Goals:

Match value proposition with account and buyer challenges

Create an engaged Champion - a person who'll introduce you to their team

Create a business case for your Champion - what exact challenges your product will help to solve.

Create a buyer enablement content to address all potential questions from the buying committee and add a social proof

KPIs:

Sales opportunities

Account-to-pipeline ratio

When we first introduced this concept to the new clients, we were blown away with the results after the quarter pilots.

Read the case studies:

In the next section I’ll show you how we have applied this framework to generate 1 closed won and 4 sales opportunities from an ABM program in Q4 2025.

What’s included with the course access:

12 modules covering step-by-step ABM strategy development: goal decomposition, ICP, account list building, ABM team, warm-up and activation playbooks, reporting, scaling ABM and building a cohesive ABM & demand gen function.

Short explanation videos and “how to” examples. We believe it’s better one time to see a practical example then listen to the theory hundreds of times.

5 orchestrated and ready-to-use ABM playbooks and a detailed explanation

Report dashboard for 4 types of ABM programs: new revenue, pipeline acceleration, expansion and churn prevention

Live case studies and examples of the campaigns we implemented with the clients of Fullfunnel.io in the past few years

17 templates to simplify your ABM strategy launch: ICP, revenue analysis, intent data tracking, account warm-up cadence, customer research, account scoring and prioritization, ABM budget planning and forecasting, account planning, reports, personalized offers, and many more.

Planning & Presenting a Pilot ABM Program to Execs and Sales Framework

Minimal viable stack recommendation and guidelines on how to use it to avoid ramping up budget and being pressured to show ROI for the purchased $50k software

How we selected accounts for Fullfunnel.io ABM program in Q4 2025

In Q4, we ran a quarter ABM campaign with 51 accounts. One became closed won, 4 became sales opportunities. Here is how we selected the accounts:

Here is how we applied our account prioritization framework.

1.REVENUE POTENTIAL.

We looked at companies that fit our Tier 1 & Tier 2 criteria. These accounts represent the highest value and largest scale targets.

Company Size: Large scale (201–500 / 501–1,000 / 1,000–5,000 employees)

Annual Revenue: >$50M

Distributed GTM Teams: 3 or more business units or Go-To-Market teams

Sales + Biz Dev Size: 50+ members

Marketing Team Size: 10+ members

Industry: Enterprise B2B SaaS

Priority Markets: US, Canada, UKI, Benelux, DACH, France, or Nordics.

2. LEVEL OF AWARENESS.

We paid attention to several criteria:

Spikes in visiting our consulting page in the last 90 days. We set up a filter in Dealfront applying our qualification criteria. Accounts with a high engagement score were added to the draft list.

Known engaged buyer (see next point)

2+ buying committee members are subscribed to our Substack newsletter

3. RELATIONSHIP.

We prioritized accounts where we had a known engaged buyer (the matching was contact->account level):

We had recent engagement or conversation on LinkedIn

A contact has signed up and attended at least one of the previous 10 episodes of Full-Funnel Live

A contact is subscribed to our newsletter more than for 6 months

4. PRODUCT-NEED EVIDENCE.

We looked for a combined evidence between 1st party and 3rd party signals.

1st party signals:

Reading ABM articles on our blog or Substack

Attending ABM-related podcast episodes

Visiting our consulting page

3rd party:

Growing a new regional team and actively hiring SDRs and AEs (they will need marketing support)

Promoting enterprise case studies and sharing enterprise logos on the website

Executive interviews mentioning expansion to a new market

LinkedIn posts mentioning ABM initiatives or purchasing ABM platforms

One takeway (though with a hindsight it is obvious) that the most responsive and engaged accounts were those who matched all 3 criteria:

Were connected or following us on LinkedIn

Reading newsletter for 6+ months

Attended at least one of our events

Which proves our theory:

Always focus on the most engaged accounts and invest in cluster awareness. Your future pipeline is created today.