🕵🏻♂️ Attribution

A framework we use to end the "prove it's marketing-sourced" debates and build a true CFO alignment.

In a recent interview for “The State Of Full-Funnel B2B Marketing”, one CMO shared a challenge almost all other CMOs confirmed:

Honestly, our challenge often comes down to how sales, marketing, and leadership define and view the pipeline. In my case (in fintech), deals can take months (sometimes years) and involve a lot of back-and-forth before a decision. Yet the focus from the top is often on quick wins, rather than how opportunities actually mature over time.

Attribution makes this even trickier.Our customer journeys aren’t linear (people might read our content, attend an event, see us on LinkedIn, talk to a partner, and only then reach out to sales). But in the CRM, all that early influence tends to disappear, and the “credit” goes to whatever the last touch was before the deal.

That creates a gap in understanding and undervalues marketing’s role in creating the conditions for a sale/deal.

Add tighter budgets and the push for short-term ROI, and it’s even harder to invest in the long-term trust building our market might actually need to grow.

Today we'll cover:

The blended attribution framework that stops CFO debates about marketing ROI

How to shift from "marketing vs sales-sourced" to allbound revenue attribution

The revenue metrics that actually matter for long-cycle B2B companies

BECOME A FULL-FUNNEL B2B MARKETER

Full-Funnel Academy is a comprehensive B2B marketing training and Slack community for B2B marketers who care about revenue and want to move the needle.

Academy includes:

All our B2B marketing courses including ABM playbook, Demand Gen Playbook, LinkedIn Allbound marketing playbook and 11 more courses that aren’t available publicly + all upcoming courses.

Private Slack community to answer all your questions

Personalized learning plan. If you are not sure what skills you’d develop in the first place and how to get maximum from the program, we can create a personalized learning plan accordingly to the time you can dedicate to education.

Behind-the-scenes sessions. See what’s working and what doesn’t work and why on the “behind the scenes” sessions where we review the campaigns we are running for our clients and us.

Learn more and join the academy here.

The Attribution Drama

B2B marketing budgeting and forecasting has become drama theater because of attribution gaps.

CFOs expect CMOs to present leads and marketing-sourced revenue forecasts to justify budgets.

Can't prove leads/pipeline? Cut!

But there's our fault as well.

Jon Miller nailed it at our Full-Funnel Summit:

"We treated marketing like a gumball machine. I would go to my CFO and say if we need to double the number of leads, then I'm gonna need to double my budget. We taught them to think you put a quarter in, you get an MQL out."

*Watch Jon’s keynote here: https://fullfunnel.substack.com/p/revenue-marketing

The reality: B2B buyer journeys happen across multiple touchpoints over months. But CRM only captures the last touchpoint, creating a false picture of what actually drives deals.

This attribution gap is why marketing gets blamed for pipeline misses when the real issue is measurement, not performance.

Here is a real case we’ve witnessed with one of our clients.

They hosted a field event for existing customers (goal - renewals) plus tier-one prospects. Total cost: $15K. No immediate sales from the event.

Leadership's reaction?

"These events are costly and don't generate immediate pipeline. Let's cut them."

Three months later: $400K in renewed contracts and a $265K new logo deal.

But here's the kicker - nobody attributes that revenue to the event.

The renewals were seen as "customers loving the product anyway," and the new logo was attributed to "brand search" in analytics.

Drive pipeline THIS quarter with full-funnel ABM programs.

If any of these challenges sound familiar:

You are aligned in theory with sales but don’t do anything in practice aside from receiving wish lists from sales and sharing with them your marketing plan. In reality, you work in silos and miss the revenue targets and are being pressured by your executives.

You understand that your marketing and sales playbook is broken (mqls, gated content) but despite many attempts you don’t know how to fix it

Your outbound, paid ads and organic pipeline drastically decreased while CAC increased mostly because most of your market is problem unaware and not buying.

You lack brand awareness among target accounts and sales can’t get even a reply.

You clearly see that you're already behind your revenue targets

We can help.

We'll develop a custom full-funnel ABM strategy aligned with your resources, budget and stack and execute it together to drive results THIS quarter.

The Blended Attribution Framework To Stop Attribution Drama

In the last 5 years, there has been a spike of debates about the importance of self-attribution and a rise of end-to-end analytics software (most prominent are Clearbit, HockeyStack, and Dreamdata) that help you to capture the digital traces across multiple platforms and channels.

But the truth is that neither end-to-end analytics nor self-attribution solely will give you a full picture. The best insights come from a blended attribution model that consists of 3 pillars:

Self-attribution ("How did you hear about us?" added to the webforms on your website). While it gives you good insights about the core channel the buyer became aware of you, you shouldn’t expect miracles. As Nick Wentz from Clearbit shared on our live podcast: "We tested self-reported attribution on 100 demo bookings and found it's a unicorn - maybe one out of 100 writes a good story you can use. Many just wrote 'Google' - but was it organic search, an ad click, which ad, what did they search for?"

At the end of the post, I’ll share the recording of our chat with Nick where he shows the model and dashboards.

Channels that were identified in the digital analytics - Track all touchpoints across your marketing automation, CRM, and website analytics. Stefan from Dreamdata explains: "When we have a demo call booked on our website, there's an average of five touches involved. The last session is always direct because they know us and need to talk now, but the CRM books that as the conversion source - making all previous marketing spend look like a waste."

Customer interview - This is your “secret sauce”. You need to embed questions about the buying journey into either discovery calls (and train your SDRs) or into onboarding calls (train CS). Key questions to ask:

How did you first hear about us?

What were the most value-added interactions with our company? Webinars, articles, case studies, etc?

When looking for a solution like ours, how do you go about it? What steps do you usually take?

Did you take all these steps when purchasing our product? Do you remember specific questions you asked your peers or Googled for?

When you combine the insights from all three sources, you’ll have close to real picture of the buyer journey, and what influenced it.

But the blended model itself without changing the attribution method in the organization would be useless.

In the next section, I’ll share what works for us to implement this model and how to shift from "marketing vs sales-sourced" to allbound revenue attribution.ow to shift from "marketing vs sales-sourced" to allbound revenue attribution.

To implement a blended attribution model, you need to come to the CFO with the data and anecdotes. Here is the framework we use.

1. Interview your leadership (including the CFO) about their recent expensive purchases.

Ask:

How did they become aware of that vendor?

What were the main touchpoints?

How would they attribute it if they worked for that vendor?

Collect these anecdotes for your CFO conversation.

2. Collect evidence from 2-3 new customers.

If there are any onboarding/implementation calls scheduled, share the context with CS and ask them to invite you to the call.

Another alternative is to share with an account owner (AE or CS) that you want to collect insights about the buyer journey via a short interview and that you’ll reach out to the Champions from these customers.

Here is a simple email or LinkedIn message you can send:

Hi, Name.

Thanks a lot for signing with us recently. I’m a CMO (your title) and always keen to make our marketing better and more valuable for our customers. Can I ask you for a favor and answer a few questions?

How did you first hear about us?

What were the most value-added interactions with our company? Webinars, articles, case studies, etc?

When looking for a solution like ours, how do you go about it? What steps do you usually take?

Or, if it's easier, I’d appreciate a 10-minute chat.

Thanks a lot for your help.

YOUR NAME.

Answers to the most common questions:

Who schedules interviews? CMO or marketing team member.

When to do it? Join upcoming CS calls or schedule 10-minute conversations with recent customers

How often? Once is enough to collect CFO evidence. After that, incorporate these questions into your standard discovery or CS process

3. COLLECT ALL DIGITAL TRACES AND OFFLINE INTERACTIONS.

Most B2B CMOs deal with incomplete data and digital traces scattered across multiple platforms. But that shouldn’t stop you—start with what you have.

Take the same 2-3 customers and start your analysis: CRM, marketing automation, event forms, etc. Also, interview account owners about the key interactions—chances are high that not all of them were added to the CRM.

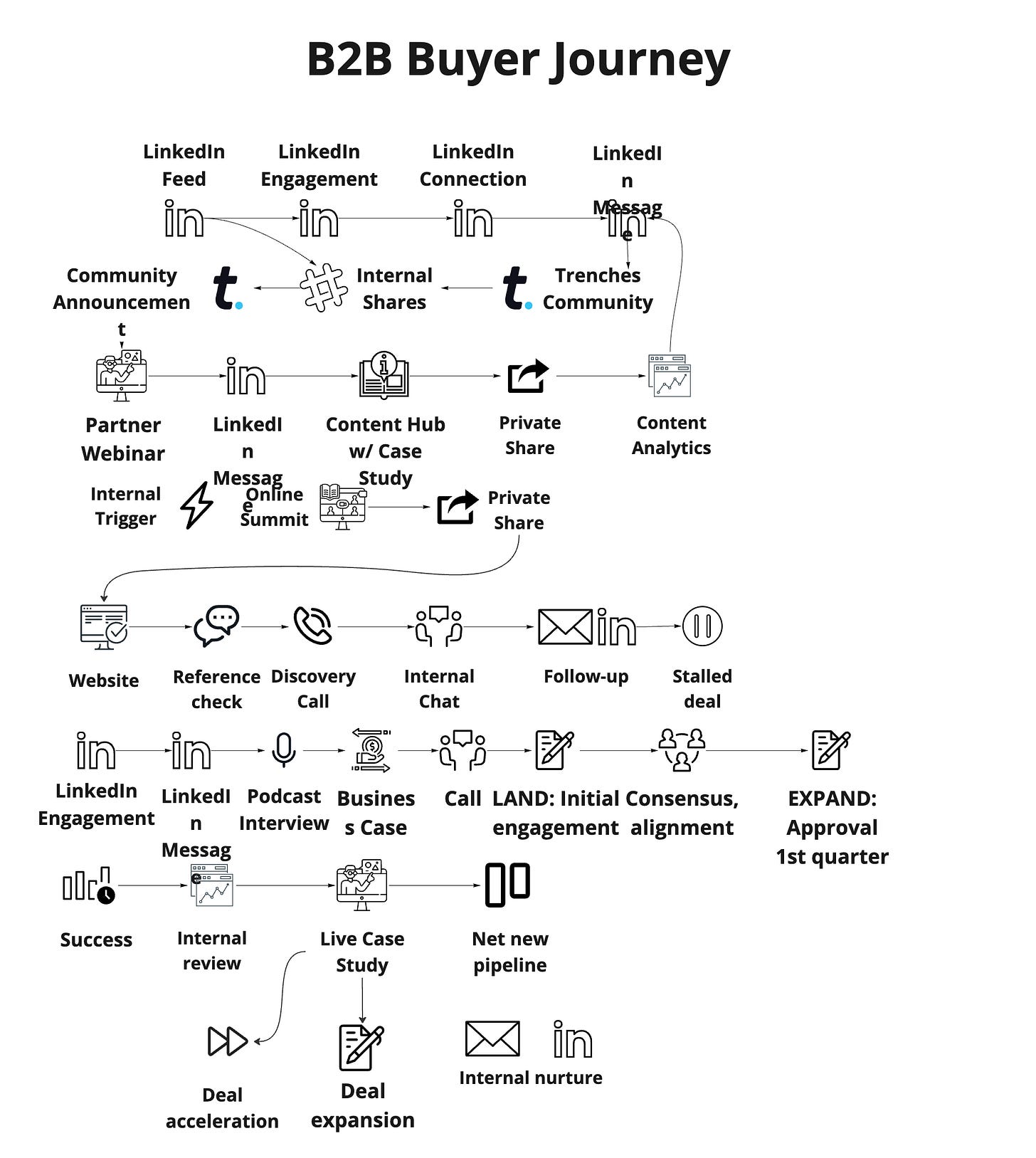

When you have everything in place, structure them in order from awareness to closed-won and, optionally, create a visual buyer's journey.

Here is the example.

*Read the whole post of how we mapped out 42-touchpoint buyer journey using the same framework here: https://fullfunnel.io/buyer-journey/

4. BOOK A MEETING WITH CFO AND RUN AN ATTRIBUTION QUIZ.

Book a meeting with your CFO and leadership team. Walk through your deal analysis and collected anecdotes from your leadership interview. Here's a simplified example:

The Buyer Journey:

Buyer discovers company through webinar promoted in newsletter

Sales rep sends cold email cadence - no reply

Buyer shares webinar recording internally

Decision-maker engages with LinkedIn content

Decision-maker meets sales rep at conference, agrees to reconnect but doesn't reply to follow-ups

Decision-maker reads case studies on website

Buyer contacts references independently

Buyer emails sales rep requesting discovery call

Now run the CFO Quiz:

Which touchpoint gets attribution credit?

Is this marketing-sourced or sales-sourced?

How do we calculate CAC across multiple channels?

What's the ROI of the LinkedIn content, webinar, case study and references?

The ideal outcome?

Your CFO understands B2B attribution complexity and asks about the solution.

5. AGREE ON ALLBOUND OR MARKETING-INFLUENCED ATTRIBUTION, AND SALES CREDITS.

Establish two attribution categories as your default model:

ALLBOUND: All deals where marketing and sales worked together (e.g., ABM campaigns) should be attributed as ALLBOUND.

Marketing-Influenced: Deals with several marketing touchpoints but without coordinated marketing focus should be marked as marketing-influenced.

To avoid any changes in sales compensation, the sales rep who owns the account still gets commission credit.

This approach stops the "marketing vs sales-sourced" debate entirely. Instead of fighting over attribution, you're measuring collaborative revenue generation.

6. AGREE ON MARKETING REPORTS AND KEY METRICS.

We need to agree with the CFO on how we attribute marketing, report on marketing, and what metrics we should track. Below are two key reports and the suggested metrics.

1.Revenue report.

Create a holistic dashboard that tracks revenue breakdown by new logos, expansion and renewals, sales pipeline velocity for accurate forecasts, and, optionally, marketing-influenced and ALLBOUND revenue.

Pipeline velocity shows your revenue trajectory based on current revenue metrics. It leads to revenue alignment between marketing and sales and shared plans on how to:

Increase win rates through better targeting

Shorten sales cycles with buyer enablement

Increase ACV through better positioning

2. Marketing Programs Reports.

Every marketing program should contain leading and lagging indicators that are connected to revenue. Take a look at this webinar report.

This report shows CFOs and leadership how "soft" marketing activities impact both new logo, expansion, and renewal revenue.

*These reports are a part of the GTM toolkit available in the GTM playbook: https://fullfunnel.io/b2b-marketing-strategy-playbook/

Full-Funnel Metrics.

Here are three categories of metrics we recommend tracking.

1. Revenue Metrics.

Marketing-influencer revenue and ROI (budget management efficiency) - Track across new logo, expansion, and renewal revenue.

Win rates - Compare ALLBOUND vs marketing-influenced vs sales-sourced.

Sales cycle length - Shorter cycles = revenue acceleration

Average contract value - Are you hunting antelope or field mice?

Pipeline velocity - Your revenue trajectory indicator and accurate forecast of where you’re likely to be at the end of the year with the current metrics

2. Pipeline Metrics.

Track them to measure the efficiency of marketing programs (especially, shared programs with sales).

Account-to-pipeline ratio - How many target accounts become opportunities?

Engaged accounts - Target accounts that hit your engagement threshold but not sales-ready

Marketing-sourced and allbound pipeline - Inbound requests + ABM-generated opportunities

3. Brand Metrics.

Media invites - Podcast invites for your team members and leadership, speaking gigs, guest post requests (quality matters)

Brand mentions - How often you're recommended in communities and on social

Brand traffic - organic and via LLM recommendations

BECOME A FULL-FUNNEL B2B MARKETER

Full-Funnel Academy is a comprehensive B2B marketing training and Slack community for B2B marketers who care about revenue and want to move the needle.

Academy includes:

All our B2B marketing courses including ABM playbook, Demand Gen Playbook, LinkedIn Allbound marketing playbook and 11 more courses that aren't available publicly + all upcoming courses.

Private Slack community to answer all your questions

Personalized learning plan. If you are not sure what skills you’d develop in the first place and how to get maximum from the program, we can create a personalized learning plan accordingly to the time you can dedicate to education.

Behind-the-scenes sessions. See what’s working and what doesn’t work and why on the “behind the scenes” sessions where we review the campaigns we are running for our clients and us.

Learn more and join the academy here.

Implementation Notes: What to do when things go wrong and the success metrics.

Obviously, the implementation of this framework is not an easy task, per se. Here are some thoughts on how to make it smoother, plus answers to the most common questions.

Starting with Imperfect Attribution.

Most CMOs deal with broken Salesforce data and marketing automation sync issues. The framework we shared works with imperfect data:

1. Missing Touchpoints (e.g. 40% of interactions untracked).

Start with what you have: "We can track 60% of touchpoints, which is infinitely better than assuming the last touch drove the deal." Use customer interviews to fill gaps and set expectations that perfect attribution is impossible, but better attribution drives better decisions.

2. Messed data in the CRM.

Focus on patterns, not perfection. Use data ranges like "Marketing influenced 40-60% of closed deals" instead of providing exact percentages. Combine CRM data, customer interviews, and digital analytics to show marketing impact holistically.

3. Historical data gaps.

Don’t try to fix the broken historical data and change the attribution of old opportunites. Start with the new opportunities and sahre insights with leadership: "Here's how attribution works for deals closed this quarter".

When Things Go Wrong.

There are several things I must aware you of.

1. CFO’s pushback.

If CFO responds to the CFO quiz: "This proves marketing can't measure anything," don’t hit the wall with your fists but reply with anecdotes: "Consider your last major software purchase - did you decide after one LinkedIn ad, or multiple touchpoints over months?"

Offer compromise: "Let's pilot this blended attribution model on 10 deals over one quarter and compare insights to current attribution."

2. Customer interviews reveal data gaps.

If customers mention untracked touchpoints (podcasts, referrals), present them as a validation and evidence why current attribution is broken: "This proves why we need blended attribution. Our current system missed a touchpoint that influenced a $200K deal."

3. Criticism of the new model from sales.

If sales says "Marketing gets credit for our deals," emphasize collaboration: "ALLBOUND attribution recognizes we worked together. It's about understanding what drives revenue, not comparing marketing to sales."

Implementation success metrics.

To make sure the new process works, pay attention to these positive signals.

Month 1-3:

CFO asks for pipeline and revenue forecasts instead of just lead counts

CFO references marketing activities in board presentations

Sales more actively co-create shared playbooks

Month 3-6:

Conversations shift from "prove it's marketing-sourced" to "how do we replicate this?"

Budget discussions reference buyer journey stages vs channel ROI

Customer interviews become part of discovery or client success calls

Month 6+:

Marketing budget grows based on pipeline influence evidence

Sales cycle length decreases through better buyer journey insights

CFO and CMO present joint revenue forecasts

Warning Signs

CFO still asks "what leads did marketing generate?" after 6 months

Sales claims they would have closed ALLBOUND deals anyway

In this case, restart with smaller pilot (5 deals), increase customer interview frequency to monthly, add more visual journey mapping, bring in external validation through customer references.

Listen to Full-Funnel Live - 𝗙𝗼𝘂𝗿 𝗔𝗕𝗠 𝗣𝗿𝗼𝗴𝗿𝗮𝗺𝘀 𝘁𝗵𝗮𝘁 𝗗𝗿𝗼𝘃𝗲 $𝟳𝗠 𝗣𝗶𝗽𝗲𝗹𝗶𝗻𝗲.

*If you want to attend the next live episode, sign up here to receive an invite. Usually, we host them every Wednesday at 4 pm CET (Central Europe) - 11 am ET (Eastern Time).

I sat down with Nick Wentz from Clearbit to nail down B2B attribution model. We covered:

How to score leads on intent/engagement and personalize marketing activities to generate opportunities

What data points should be added to your attribution model

How Clearbit uses attribution and intent models in ABM campaigns

Tune in below.

Really like the clarity in how you’ve framed attribution here, especially the CFO lens.

I’ve been digging into similar challenges on my own Substack around attribution and the direction of travel in B2B adtech, and this piece definitely sharpened a few angles I want to explore further. Great read!