How to leverage intent data to drive pipeline

We cover 4 categories and 16 sources of intent data for ABM, most important intent triggers on LinkedIn and how to create a clear process for marketing and sales to leverage intent data.

Today we want to share:

4 categories and 16 sources of intent data for ABM - prioritize what’s important for you

15 pillars of intent data you SHOULD track on LinkedIn

Step-by-step process for tracking, qualifying and sourcing intent data to sales

Examples of intent triggers and actions for marketing and sales

Quick question

During summer break we plan to record a few new courses. Which one you’re likely to enroll in? Vote below, please.

Let’s dive in.

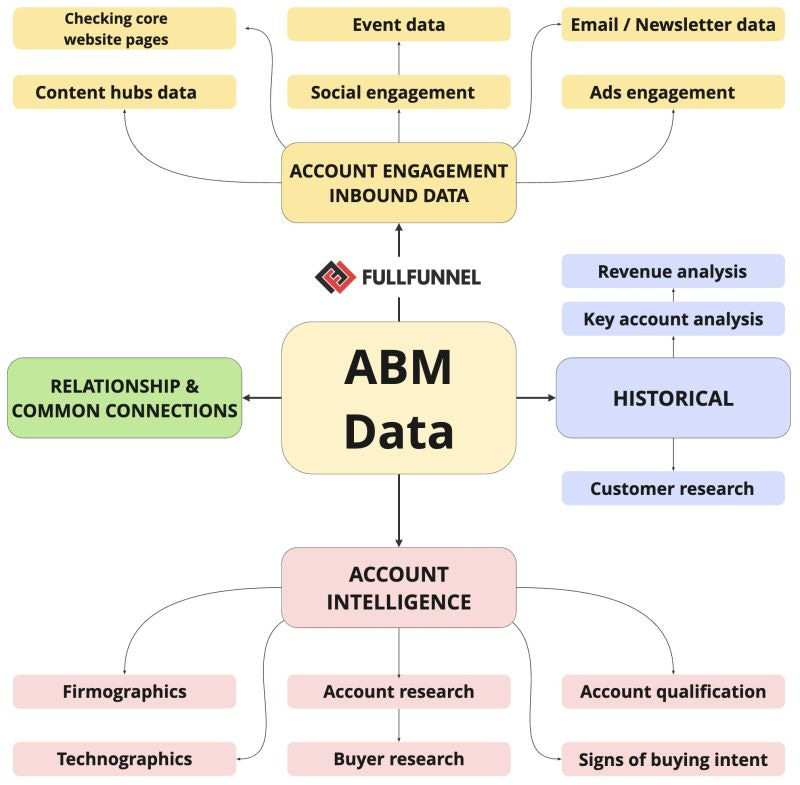

ABM data sources

Let’s start with reviewing the most important sources of intent data. We put them into 4 categories. Discuss with sales what’s really important for your company, then build a stack.

1. HISTORICAL DATA.

The key to successful ABM lies in answering the question:

How can I replicate my best deals?

Here are 3 sources of data:

1. Revenue analysis.

What industries and verticals generate the highest revenue?

2. Key account revenue analysis.

Look at the companies from a selected vertical with the highest revenue. What do they have in common?

Use these criteria as account qualification criteria for list building.

Analyze lost deals, define patterns, and use them as disqualification criteria.

3. Run customer research.

Host 1–1 sessions with key customers to understand their buying process:

What triggers it?

How do they search for the information?

How do they select and evaluate vendors?

Who is involved in decision-making?

Why did they select your company

Our friend Pierre Herubel recorded a great course on developing B2B content marketing strategy. If you want to upskill yourself or your team, check the agenda and use a code FULLFUNNEL24 to get 16% off.

2. RELATIONSHIP & COMMON CONNECTIONS.

Do we have any common connections that can make us an intro or support us with insider information?

Do we have any experience working with anybody from the account? Or working with companies where key stakeholders worked?

Become a better B2B marketer

If you are a B2B marketer, your core KPIs are really simple: sales-qualified opportunities and revenue. Period.

To generate sales-qualified opportunities and influence revenue metrics such as ACV, deal close-rate and sales cycle length, you need to run demand generation, account-based marketing, lead nurturing, deal expansion and sales enablement campaigns.

It might be frustrating, especially, if you don’t have a prior background or experience of selling to mid-size/enterprise accounts.

So isn’t it time you stopped guessing at every turn… and started running these campaigns with a proven process, frameworks and techniques?

Select on-demand self-paced B2B online training courses to ramp up your skills and accelerate revenue at your company:

Full-Funnel Academy (includes lifetime access to all our courses, private community and events)

3. ACCOUNT ENGAGEMENT OR INBOUND DATA.

This layer helps to identify accounts that are already aware of our company and engage with us.

5. Website traffic intent.

Do they check high-intent website pages: case studies, pricing, book a demo?

6. Event data.

Are they signing up for nurturing or product webinars, or podcasts?

7. Email nurturing / newsletter data.

Are they subscribed to our newsletter? What links do they click? What newsletters do they open?

8. Content hubs data.

What key content do they consume? Are their repetitive visits? Do they share it with their colleagues?

9. Social engagement.

Do they like, comment or share our social content or provide feedback in DMs?

10. Ads engagement.

Are they clicking links or engaging with nurturing ads?

4. ACCOUNT INTELLIGENCE.

11. Account qualification.

Do the accounts fit our ICP according to the qualification and disqualification criteria?

12. Firmographics.

What tier the account belongs based on their location, team size, revenue, funding, etc?

13. Technographics.

What technology do they use?

14. Account research.

Conduct thorough account research to gather publicly available insights about strategic initiatives and the potential needs of target accounts.

Look for management changes, funding, growth or layoffs.

15. Buying committee research.

Map out the buying committee and define key people your team needs to engage with. Understand their KPIs, needs, responsibilities, and their role in the strategic initiatives.

Personalize your message and offer accordingly.

16. Signs of buying intent.

Are they looking for your product on the review websites?

Are they asking for your product category recommendation on social or in communities?

Are they actively searching for your product-related keyword?

Drive pipeline THIS quarter with a full-funnel ABM programs.

If any of these challenges sound familiar:

You are aligned in theory with sales but don’t do anything in practice aside from receiving wish lists from sales and sharing with them your marketing plan. In reality, you work in silos and miss the revenue targets and are being pressured by your executives.

You understand that your marketing and sales playbook is broken (mqls, gated content) but despite many attempts you don’t know how to fix it

Your outbound, paid ads and organic pipeline drastically decreased while CAC increased mostly because most of your market is problem unaware and not buying.

You lack brand awareness among target accounts and sales can’t get even a reply.

You clearly see that you're already behind your revenue targets

We can help.

We'll develop a custom full-funnel ABM strategy aligned with your resources, budget and stack and execute it together to drive results THIS quarter.

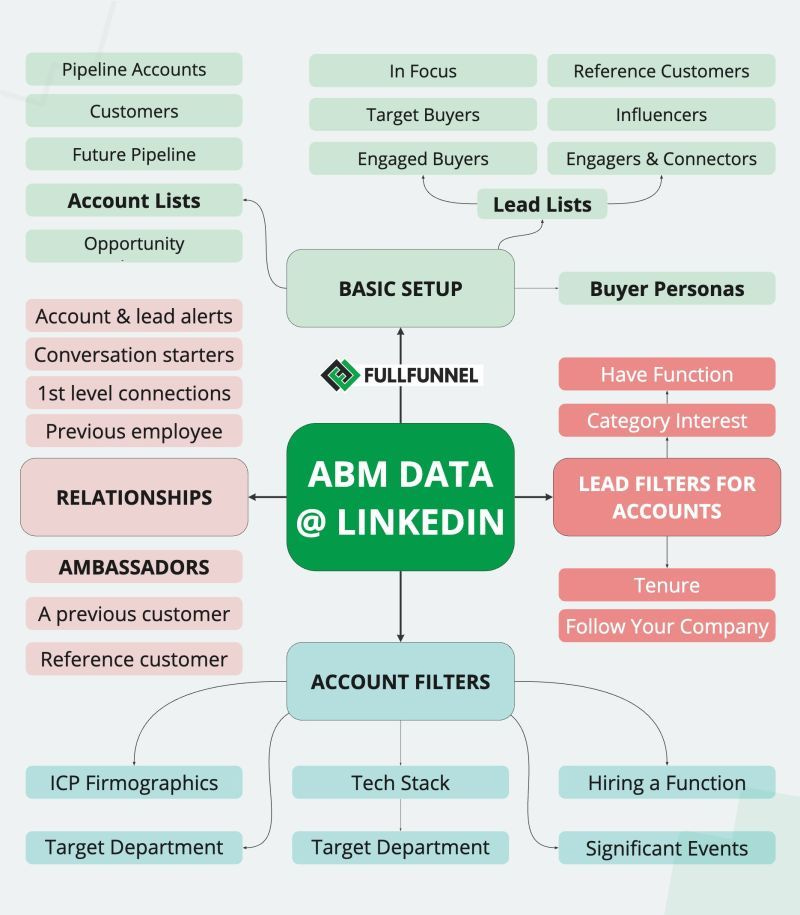

15 pillars of LinkedIn intent data

Here are 15 pillars of ABM data we use.

ACCOUNT FILTERS

Below are examples.

1. ICP Firmographics: location - United Kingdom. Team size: 1k - 5k employees.

2. Tech Stack: use Dealfront

3. Target Department Size: 100+ sales team

4. Sales Department Growth: >20%

5. Hiring a Function (Jobs): hiring an ABM manager.

6. Significant Events: Funding in the last 6 months.

LEAD FILTERS FOR ACCOUNTS

Lead filters help to streamline account research.

7. Have Function: companies that have employees with a specific title - VP of ABM

8. Tenure: a decision maker is in their role for 3-12 months

9. Following Your Company: companies that are aware of you.

RELATIONSHIPS

10. Previous employee works at a target account

11. You or your colleagues are connected to buyers in the target account

12. A previous customer or a power user hired by a target account

13. A customer is connected to a decision maker from a target account

14. Profile visits - notifications about people from target accounts visiting your profile.

15. Lead alerts for outreach triggers or conversation starters: recent post, job role change, events, etc.

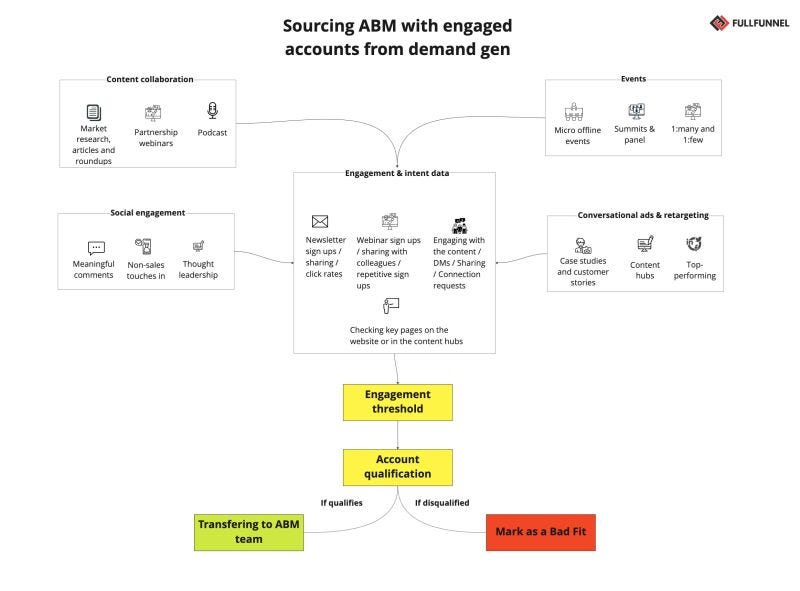

How to track, qualify and source intent data to sales: Step-by-step process

Here is a sad reality about how intent data platforms are used in B2B companies.

Marketing purchases intent data platform and tells sales about sourcing them engaged accounts. Everybody becomes excited about a new silver bullet.

Marketing adds identified accounts to generic retargeting without qualifying and researching them.

Sales selectively picks up potential buyers from the identified accounts and pitches them.

In a few weeks the excitement goes down because of lack of results. The majority of sales reps start ignoring the platform.

To make sure intent data works you need to:

Focus on a few sources and tools

Create operations about capturing, qualifying and sourcing data

Here is a step-by-step process.

1. 𝐃𝐞𝐟𝐢𝐧𝐞 𝐭𝐨𝐠𝐞𝐭𝐡𝐞𝐫 𝐢𝐧𝐭𝐞𝐧𝐭 𝐚𝐧𝐝 𝐞𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐬𝐨𝐮𝐫𝐜𝐞𝐬.

Webinars, field events, website traffic, third-party intent - whatever your marketing and sales teams are using, write it down.

Don't be obsessed with multiple sources. Select 5-7 most important sources and software that provides it.

We use:

Dealfront for website intent and social signals about target accounts

LinkedIn Sales Navigator for social signals

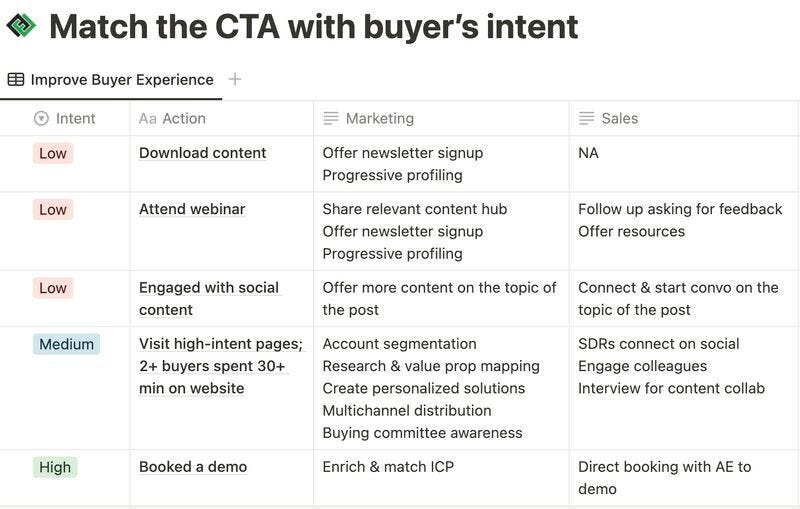

2. 𝐌𝐚𝐭𝐜𝐡 𝐢𝐧𝐭𝐞𝐧𝐭 𝐚𝐧𝐝 𝐞𝐧𝐠𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐰𝐢𝐭𝐡 𝐭𝐡𝐞 𝐛𝐮𝐲𝐞𝐫 𝐣𝐨𝐮𝐫𝐧𝐞𝐲.

Signing up for a webinar ≠ buying intent. Take a sober look at the buying process and match engagement accurately with the right stages.

3. 𝐃𝐞𝐯𝐞𝐥𝐨𝐩 𝐣𝐨𝐢𝐧𝐭 𝐩𝐥𝐚𝐲𝐛𝐨𝐨𝐤𝐬.

Stop saving every contact as MQL and transfer to sales. Instead, develop playbooks that match the buying journey.

Example.

After signing up for a webinar, marketing adds a contact to the retargeting layer with more content around the topic and case studies.

Sales connects, asks for feedback and tries to understand how they can be helpful at this moment.

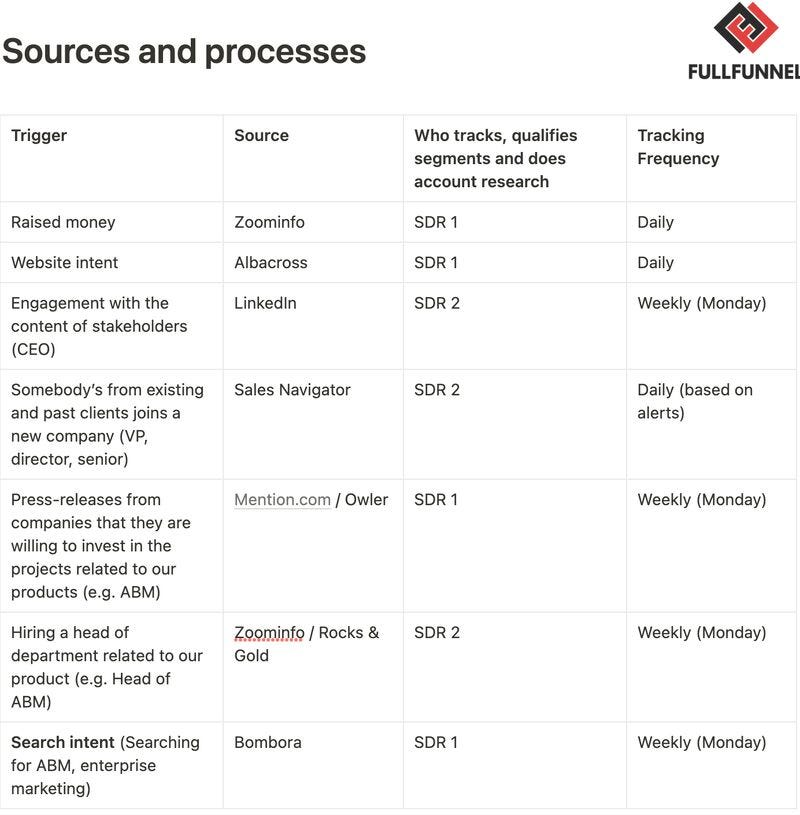

4. 𝐃𝐞𝐟𝐢𝐧𝐞 𝐭𝐡𝐞 𝐬𝐨𝐮𝐫𝐜𝐞 𝐨𝐰𝐧𝐞𝐫𝐬.

If multiple people are in charge of tracking a specific intent or engagement source, it will never work.

Define a responsible person and define the tracking frequency.

5. 𝐃𝐞𝐯𝐞𝐥𝐨𝐩 𝐒𝐎𝐏𝐬.

Develop a clear process that includes:

Tracking process overview/best practices

Qualification (checking that contacts fit ICP)

Tier segmentation (to what tier the contact belongs to)

Lead handover

6. 𝐒𝐲𝐧𝐜 𝐚𝐧𝐝 𝐫𝐞𝐟𝐢𝐧𝐞.

Make sure that you have regular sync meetings where you review and refine the process.

Live examples of leveraging intent data

In the recent episode of Full-Funnel Live we share live examples of how to leverage intent data to:

Define highly engaged accounts that should be added to account-based marketing programs

Matching next actions and call to actions with the intent level